Author Archive

Miles said:

USD / Debt / Gatekeepers

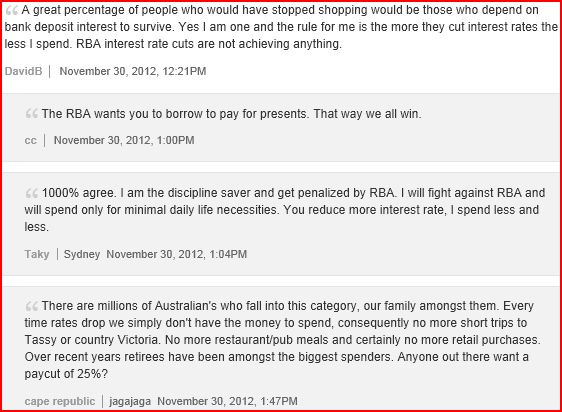

Following are some comments that were generated by this article written by Colin Kruger, published today by Fairfax on the AGE website. I thought the comments reflected an interesting dynamic and were worth highlighting.

Friday, November 30th, 2012

Miles said:

European Investments – follow up

I was fortunate to stay for a few days in Porto, Portugal on our recent trip to Europe. While I was there I spent a Saturday touring the city which included a guide led tour of Palacio da Bolsa. The building was commissioned in 1851, it was developed in stages, the works were completed fifty years later. The building was established by private businessmen as a center of commerce and trade. It was the site of the Porto Stock Exchange until it was merged into Lisbon in 2001 and it continues to operate as the site of the local Chamber of Commerce.

As we were guided from room to room we entered a small Law Court. The painting on the ceiling (pictured above) was described by the guide as representing the Courts’ function of defending the institutions of trade and commerce.

The irony was not lost; I felt the sentiments expressed over a hundred years ago in this painting are appropriate today. It also aligns with our thinking that the current European issues aren’t something new, more so their genisis lies in multi generational cultural differences.

Thursday, July 19th, 2012

Miles said:

European Investments:

23% of the fund’s capital is invested in European companies; the exposure is spread across four investments in two discrete ideas. Nigel and I are visiting companies in France, Germany, Austria and Turkey later this month and it is reasonably likely this exposure will increase.

At its core, we view the European investments to be in outstanding businesses that we regard as being well managed, have appropriately structured balance sheets, cultures of strong corporate governance / disclosure and at an operating level are performing strongly. The valuations also strike us as compelling; to put this in context we regard the European assets as being higher quality than their Australian counterparts and they are trading on approximately 40% the valuations on an unlevered basis.

The issues we have to manage with these investments relate to macro and sovereign risk concerns. Frankly, we do not have a view on what is likely to happen in Greece or the sustainability of the Euro. The way we have approached the macro concerns is on a worst case basis. We have tried to address questions of “Will these companies survive if the Euro doesn’t?” and “Are we at risk of structural change being imposed by sovereigns at the expense of business owners”. Given the fund owns these businesses, it almost goes without saying we think the answer to the first question is yes, they will survive and to the second, we think governments will maximise their revenues from these businesses by maintaining the status quo.

To date, our European investments have performed reasonably in both local currencies and AUD terms. I think the performance is worth highlighting in the context of the current mainstream focus concerning Europe and the Euro; that despite the current fear and uncertainty there is still a degree of differentiation and stability in how assets and companies are being priced.

Day to day we expect these investments to be volatile. Our sense is this volatility and uncertainty is scaring away many investors. The volatility doesn’t concern us and to an extent we think we can manage the extreme downside risks the market is fearful of. We think we will be well compensated for investing here, rather than waiting for the environment to feel safer.

Miles said:

Fund Positioning 01_11_2013

Monday, November 4th, 2013